This gem just in http://bit.ly/vTok8. Now they have gone too far! Many believe, this author included, that the credit ratings agencies are one of the biggest culprits in the great credit crisis and crash of 08. AAA credit ratings were handed out like beads at Mardi Gras. Wall street did not even have to lift its shirt, just keep a stream of lucrative payments flowing. They were paid fees by banks who sometimes pressured or shopped around for the most favorable risk assessments, an obvious conflict of interest. Enron, remember that now quaint little scandal dwarfed by today's affairs? Enron was rated AAA days before going bust. AIG, Bear Stearns, Mortgage backed Securities, Banks laden with derivatives of every stripe and color, all handed superior if not the highest ratings. Then after the crash when down grades of these very institutions led to the need to raise capital at a time when it wasn't available only exacerbated the issue and lead to the markets death spiral that was last fall and early 09. Now they have set there sights on the Mother Land, the Emerald Isle, the once Celtic Tiger. In all seriousness, a sovereign downgrade to Aa1 with outlook negative leading to more cuts is a very serious matter. Much of Europe particularly the former eastern block is in similar if not much worse shape. Seeing as to much of the developed world moves in lockstep economically this situation does not bode well for the green shoots of optimism crowd.

A much worse than expected NFP report on Friday lead to a greater than 2% slide in the S&P 500, with a close below 900 and the 50 day moving average. Stunted holiday volume was the only savior on the day. As I have mentioned many times recently, a date with 875 is imminent. I surmise the level will hold and launch into another failed run at 950 on the index over the mid summer. For those with the ability to analyze, and act, this is actually a great time to be in the markets. Happy 4Th and good trading!

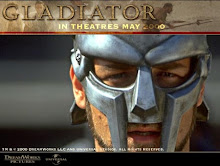

Cool Pic, happy fourth to you too!

ReplyDelete